One of the first things to evaluate when selling gold is the current industry trends. Precious metals prices vary based on various elements, including financial conditions, inflation rates, and global demand. Staying an eye on these trends can help sellers decide the optimal time to transact. For example, if the price of precious metals is elevated, it may be a favorable opportunity to sell. Conversely, if prices are diminished, it might be prudent to hold off until they rise. Investigating industry trends can provide insightful information and help vendors make informed choices.

Valuation is another crucial aspect of selling gold. Before placing gold on the platform, it is essential to know its value. This involves comprehending the quality of the precious metals, which is assessed in fineness, and the weight of the item. Vendors should consider getting their assets valued by a certified expert to guarantee they have an accurate assessment. An appraisal can provide a clear comprehension of the gold's market worth, which can help in negotiations with potential clients. Knowing the worth of the gold can also prevent sellers from accepting bids that are too low.

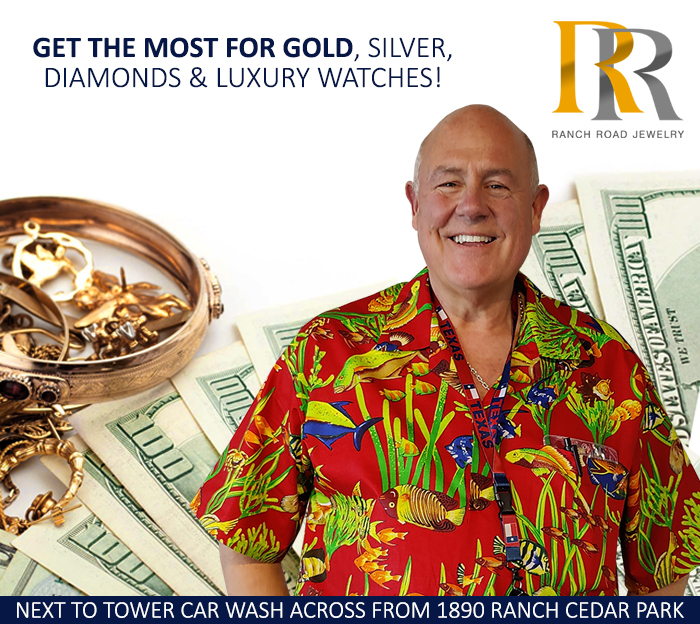

Locating the right clients is crucial in a competitive market. There are various options available for transacting precious metals, including pawn shops, digital marketplaces, and specialized precious metals buyers. Each choice has its pros and cons. For instance, pawn shops may offer immediate cash but often at diminished prices, while digital platforms can provide access to a broader audience but may require more effort to market and sell the assets. It is important for vendors to research potential buyers and choose the one that matches with their transacting goals. Establishing relationships with trustworthy clients can also lead to improved offers and a more efficient selling experience.

When selling precious metals, it is also important to be aware of the regulatory and ethical factors involved. Sellers should make sure that they are complying with local laws regarding the sale of gold. Additionally, being transparent about the state and history of the assets can build confidence with buyers. Responsible selling practices not only safeguard the seller but also add to a favorable reputation in the market. This can lead to repeat business and recommendations, which are valuable in a competitive landscape.

In conclusion, selling precious metals in a fierce market requires careful planning and consideration. By remaining informed about industry trends, comprehending the valuation of assets, finding the appropriate buyers, and complying to legal and moral standards, vendors can navigate the challenges of the gold industry effectively. With the right strategy, selling precious metals can be a profitable experience that fulfills the top article seller's monetary needs.